Top 5 Loan Calculators in the USA

NerdWallet’s Loan Calculator

When it comes to understanding your loan terms with ease, NerdWallet’s Loan Calculator stands out as a reliable and user-friendly tool. Whether you’re planning to take out a mortgage, car loan, or personal loan, this calculator is designed to make financial planning stress-free and straightforward.

Key Features

- Easy Input Fields:

The calculator’s intuitive design ensures that users can quickly input essential details such as the loan amount, interest rate, and repayment term. With its minimalistic and clutter-free interface, even first-time users can navigate it effortlessly. - Detailed Results:

NerdWallet’s Loan Calculator provides a breakdown of critical financial details, including:

- Estimated Monthly Payments: Know exactly how much you’ll pay each month.

- Total Interest: Understand the full cost of borrowing by seeing the total interest accrued over the loan term.

- Overall Loan Cost: Gain a clear picture of the total amount you’ll repay, including both principal and interest.

- Customizable Options:

Adjust the loan terms or interest rates to explore various scenarios. This feature allows users to see how changes in repayment periods, loan amounts, or interest rates impact monthly payments and overall costs. It’s perfect for comparing multiple loan options before making a decision.

Why NerdWallet’s Loan Calculator Stands Out

- Beginner-Friendly Design:

Its clean layout and straightforward functionality make it ideal for users with little financial expertise. The tool breaks down complex loan details into easily digestible information. - Real-Time Updates:

As users adjust input values, the results are updated instantly, allowing for quick comparisons of different loan scenarios. - Trusted Resource:

Backed by NerdWallet’s reputation as a leading personal finance platform, the calculator integrates reliability and accuracy into its results. - Educational Benefits:

Beyond just calculations, the tool helps users understand how loan components such as principal, interest, and term length interact. This fosters informed financial decision-making.

Ideal for a Variety of Loan Types

While particularly popular for personal loans, the calculator is versatile enough to handle:

- Mortgage calculations

- Auto loans

- Student loans

- Business loans

to make confident financial decisions. Try it today and take control of your borrowing journey!

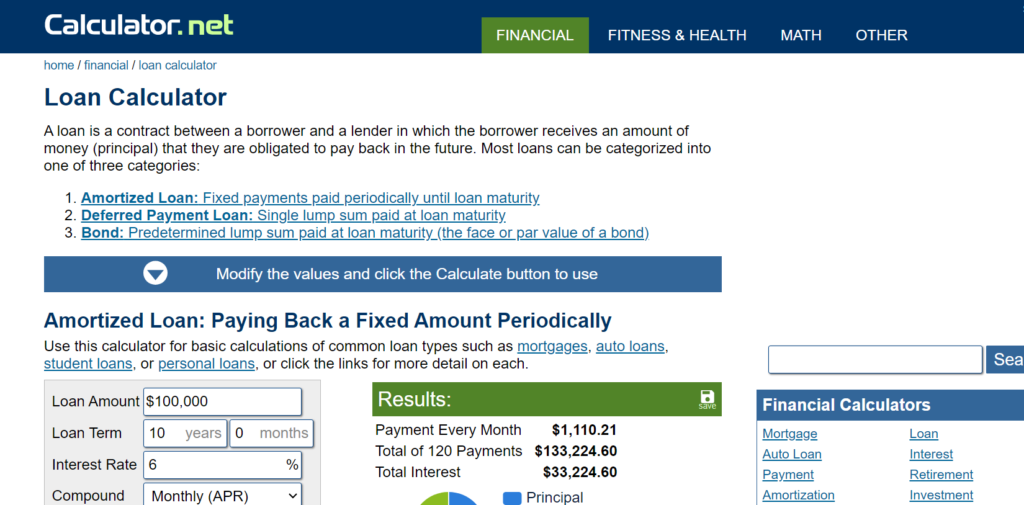

Calculator.net offers a robust and user-friendly loan calculator that caters to a wide range of financial needs, including mortgages, personal loans, and auto loans. Its intuitive design and advanced features make it a valuable resource for both novice and experienced borrowers.

Features:

- Comprehensive Calculation Options

- Enter key details such as the loan amount, interest rate, and loan term to generate detailed results.

- Provides a clear and easy-to-understand amortization schedule, showing monthly payments, interest, and remaining balances over the loan’s duration.

- Multi-Purpose Functionality

- Suitable for a variety of loan types, from home mortgages to car loans and personal financing.

- Adaptable to unique borrowing needs, making it a one-stop solution for comparing different loan options.

- Advanced Settings

- Adjust the payment frequency (e.g., monthly, bi-weekly) to align with your financial strategy.

- Include extra principal payments and see how they reduce the loan term and total interest paid over time.

- Offers flexibility for users to simulate various payment scenarios to optimize their repayment strategy.

- Customizable Results

- Customize inputs for taxes, insurance, or additional fees, if applicable.

- Provides visual graphs for a quick overview of payment breakdowns and loan progress over time.

Why It Stands Out:

Calculator.net’s loan calculator is ideal for borrowers seeking detailed, accurate, and highly customizable results. Whether you’re planning to purchase your dream home, finance a vehicle, or consolidate debt, this tool offers insights that empower you to make informed decisions.

- Extra Payment Planning: Perfect for borrowers who aim to save on interest and shorten the loan term by making extra payments.

- User-Friendly Interface: Easy for anyone to use, with step-by-step guidance for entering loan details and interpreting results.

- Time-Saving Tool: Quickly compare different loan scenarios to find the best fit for your budget and financial goals.

Who Can Benefit:

This tool is suitable for first-time borrowers, financial planners, or anyone looking to understand the implications of loan terms and payment strategies. The versatility and depth of its features make it a go-to calculator for financial planning.

If you’re considering a personal loan from Wells Fargo, their loan calculator is an invaluable tool that helps you plan your finances with confidence. This user-friendly calculator is designed to give you a clear picture of what your loan might look like, helping you make informed decisions before you commit.

Key Features of the Calculator

- Loan-Specific Calculations

The calculator is specifically tailored to Wells Fargo’s personal loans, ensuring accurate and relevant estimates based on their offerings. - Real-Time Estimations

By simply inputting the loan amount, term, and interest rate, you can get instant, up-to-date estimations of your monthly payments and overall loan costs. - User-Friendly Interface

With its straightforward design and intuitive inputs, this tool is accessible to customers of all experience levels, from first-time borrowers to seasoned loan seekers.

Why It Stands Out

- Tailored for Wells Fargo Customers

Unlike generic loan calculators, this tool is optimized for the specific terms and conditions of Wells Fargo’s personal loans. This makes it a perfect resource for anyone considering borrowing from this bank. - Transparent Financial Planning

It provides a clear breakdown of your estimated monthly payments, interest costs, and total repayment amount, giving you the transparency you need to plan your budget effectively. - Time-Saving Tool

Instead of manually crunching numbers or relying on rough estimates, the calculator provides quick and reliable results, helping you save time and effort.

How to Use the Wells Fargo Loan Calculator

Using the calculator is simple:

- Enter your desired loan amount.

- Select a loan term that suits your financial goals.

- Input an estimated interest rate or use Wells Fargo’s typical rates for guidance.

- View your customized results, including monthly payments and total costs.

Additional Tips

- Experiment with different loan amounts and terms to find an option that best fits your budget.

- Use the calculator alongside other financial planning tools to get a holistic view of your borrowing capacity.

- Remember to compare these estimates with other lenders to ensure you’re getting the best deal.

The U.S. Bank Personal Loan Calculator is a powerful tool designed to help users make informed decisions about their borrowing options. It provides a simple, intuitive interface that allows individuals to explore various loan scenarios and estimate potential costs before committing to a loan application. Whether you’re considering a small personal loan or a larger amount, this calculator can give you valuable insights into what to expect.

Features

- Rate Estimations: The calculator offers potential interest rates based on the loan amount and repayment term. This feature helps users understand the range of rates they may qualify for, making it easier to budget and plan.

- Monthly Payment Calculations: It provides a detailed breakdown of estimated monthly payments, helping users determine what fits within their financial comfort zone.

- Customizable Inputs: Users can adjust key variables such as loan amount, repayment term, and estimated credit score to see how these changes affect their overall loan costs.

- Total Loan Cost Insights: In addition to monthly payments, the calculator shows the total cost of the loan over its duration, giving a clear picture of the long-term financial commitment.

Why It Stands Out

This calculator is more than just a numbers tool—it’s an excellent resource for anyone looking to take control of their financial planning. By allowing users to compare different loan scenarios, it empowers borrowers to make confident, well-informed decisions. Its user-friendly design and comprehensive features make it particularly helpful for those in the early stages of loan shopping.

Who Can Benefit?

- First-Time Borrowers: Gain a better understanding of what to expect from personal loans.

- Budget-Conscious Individuals: Plan monthly expenses effectively by estimating loan payments.

- Comparison Shoppers: Explore various loan scenarios to find the best fit for your needs.

- Pre-Applicants: Conduct preliminary research to narrow down options before applying for a loan.

Additional Tips for Using the Calculator

- Know Your Credit Score: Having a rough idea of your credit score can improve the accuracy of the rate estimations.

- Experiment with Terms: Try different loan amounts and repayment periods to find a balance between monthly payments and total costs.

- Consult a Loan Officer: While the calculator is a great starting point, speaking with a professional can help clarify any uncertainties and provide personalized advice.

Financial Mentor offers a suite of eight powerful loan calculators designed to address a wide range of borrowing needs. Whether you’re dealing with standard loans, interest-only options, or aiming to accelerate your payoff timeline, these calculators provide the tools you need to make informed decisions.

Key Features:

- Variety of Calculators:

- Tailored to handle different loan types, including fixed-rate, variable-rate, and interest-only loans.

- Specialized tools for advanced financial planning, like accelerated payoff schedules and refinancing scenarios.

- Detailed Breakdown:

- Offers a comprehensive analysis of key loan components, including monthly payments, total interest paid, and payoff timelines.

- Includes visual charts and tables to give users a clear understanding of their financial commitments.

- User-Centric Design:

- An intuitive and easy-to-navigate interface ensures accessibility for users at any financial literacy level.

- Features customizable inputs for loan amounts, interest rates, terms, and additional payments to accommodate diverse financial situations.

Why Financial Mentor’s Calculators Stand Out:

Financial Mentor’s loan calculators aren’t just basic tools—they’re a comprehensive resource for borrowers and financial planners alike. Here’s what sets them apart:

- Comprehensive and Versatile:

The suite covers a wide spectrum of financial scenarios, making it useful for everyone from first-time borrowers to seasoned investors. - Advanced Features for Precise Planning:

Unlike many calculators, these tools provide advanced options, like adjusting for additional monthly payments or changing interest rates over time, ensuring you can plan for real-world complexities. - Educational Value:

Each calculator is paired with educational resources and explanations, empowering users to better understand the factors affecting their loans. - Time-Saving and Accurate:

By automating calculations and presenting results in an easily digestible format, the calculators save users hours of manual work while ensuring accuracy.

Whether you’re looking to evaluate a mortgage, strategize for an early payoff, or simply explore your loan options, Financial Mentor’s loan calculators are an indispensable tool to guide your financial decisions confidently.

How to Choose the Best Loan Calculator for Your Needs

When selecting a loan calculator, consider the following:

- Purpose of the Loan: Some calculators are designed for specific types of loans, like mortgages or personal loans.

- Level of Detail: Choose a calculator that provides the level of detail you need. For instance, if you’re planning to make extra payments, look for one with advanced options.

- Ease of Use: Opt for a calculator with a simple interface if you’re not familiar with loan terms.

- Bank-Specific Needs: If you’re considering a loan from a particular bank, their calculator might be the most accurate for estimating costs.

Conclusion

Loan calculators are essential tools for anyone planning to borrow money. They help you understand your financial obligations and make informed decisions. Among the top options in the USA, NerdWallet’s and Calculator.net’s tools stand out for their versatility and ease of use, while Wells Fargo and U.S. Bank’s calculators cater to their respective customers. For those seeking advanced features, Financial Mentor’s calculators are an excellent choice.

Use these calculators to explore your loan options and ensure you’re prepared for any financial commitment!